Jordan – U.S. Free Trade Agreement

The U.S.-Jordan Free Trade Agreement (FTA), signed on October 24, 2000 and entered into force on December 17, 2001. Jordan and the U.S. also have a Bilateral Investment Treaty. These agreements provide Jordanian exports with a comparative advantage in the large U.S. market and helps boost foreign direct investment from the United States.

At the time, it was the first U.S. FTA with an Arab country. Currently the U.S. also has FTAs with Bahrain, Morocco and Oman, which came as part of the U.S. Middle East Free Trade Area Initiative (MEFTA initiative) first proposed in May 2007. The MEFTA initiative “is a plan of graduated steps for Middle Eastern nations to increase trade and investment with the United States and with others in the world economy, with the eventual goal of a regional free trade agreement.

https://ustr.gov/trade-agreements/other-initiatives/middle-east-free-trade-area-initiative-mefta

President Clinton and King Abdullah II signed the JUSFTA on October 24, 2000.

Source: SUSAN A. WALSH/AP

| Side by Side Comparison of U.S. FTA with Arab Courtiers: | ||||

| Provisions | Jordan | Bahrain | Morocco | Oman |

| Implementation Date | December 17, 2001 | August 1, 2006 | January 1, 2006 | January 1, 2009 |

| Expiration | None | None | None | None |

| Duty Phase-Out | January 1, 2010 (10 years) | January 1, 2015 (10 years) | January 1, 2023 (18 years) | January 1, 2018 (10 years) |

| Merchandise Processing Fee(MPF) | Not exempted | Exempt for originating goods; 19 Code of Federal Regulation (CFR) 24.23(c)(9) | Not Exempt | Exempt for originating goods; 19 Code of Federal Regulation (CFR) 24.23(c)(11) |

| Direct Shipment Imported Directly Transit & Transshipment Third Country Transportation | Imported Directly: May NOT enter the commerce of a 3rd country except for non-retail sale where the importation is the result of the original transaction, may not undergo further production in a 3rd country; GN 18(c)(vi); 19 CFR 10.711 | Imported Directly: May leave customs’ control, may not undergo further production in a 3rd country, limited operations specified; GN 30(d)(v); 19 CFR 10.817 | Imported Directly: May leave customs’ control, may not undergo further production in a 3rd country, limited operations specified; GN 27(d)(v); 19 CFR 10.777 | Imported Directly: May leave customs’ control, may not undergo further production in a 3rd country; GN 31(d)(v); 19 CFR 10.880 |

| Primary Responsibility for Compliance | Importer | Importer | Importer | Importer |

| Rule of Origin citation | General Note 18(b) 19 CFR 10.709, 10.710 | General Note 30(b) 19 CFR 10.810 | General Note 27(b) 19 CFR 10.770 | General Note 31(b) 19 CFR 10.873 |

| Rule of Origin | “Wholly the growth, product, or manufacture” or Value Content + Substantial Transformation | “Wholly the growth, product, or manufacture” or Value Content + 19 CFR 102 or Product-Specific Tariff shift | “Wholly the growth, product, or manufacture” or Value Content + 19 CFR 102 or Product-Specific Tariff shift | “Wholly the growth, product, or manufacture” or Value Content + Substantial Transformation or Product-Specific Tariff shift |

Source: https://www.cbp.gov/

United States has 14 FTAs in force with 20 countries. U.S. FTA Partner Countries: Australia; Bahrain; Chile; Colombia; DR-CAFTA: Costa Rica, Dominican Republic, El Salvador, Guatemala, Honduras, & Nicaragua; Israel; Jordan; Korea; Morocco; NAFTA: Canada & Mexico; Oman; Panama; Peru; and Singapore.

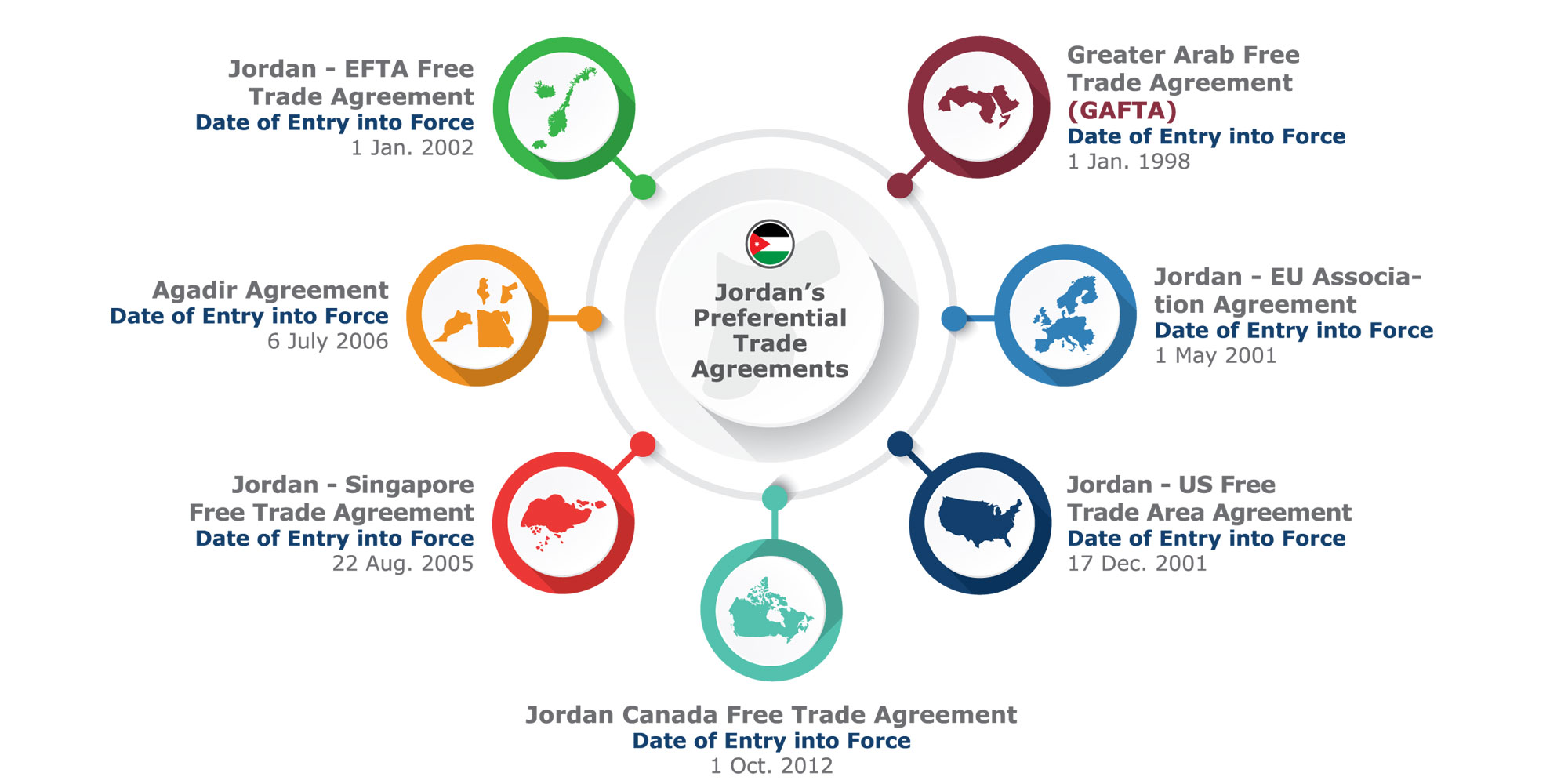

Promoting trade is a key aspect of Jordan’s economic development policy. The Jordan U.S. FTA represents a milestone in the development of Jordan’s trade policy. Jordan has been a member of WTO since 11 April 2000, and has signed multiple bilateral and multilateral FTAs with its major trading partners.

Source: http://rtais.wto.org/

Jordan continues to pursue ongoing liberalization with key partners, this includes the establishment of a “Deep and Comprehensive Free Trade Areas” with the EU, and negotiations with Mexican and Pakistan.

Brief of the FTA Provisions:

The Free Trade Agreement has seven major sections:

- Tariff Elimination: The FTA provided for the gradual eliminate of tariffs on virtually all trade between the two countries within a 10 years, which came into full effect by 2010. The table below provides of the schedule of tariff elimination.

| Removal of tariffs between Jordan and the U.S. as per the FTA | ||||

| 2000 Tariff level (%) | Phase-out period (by 2010) | |||

| <5 | 2 Years | |||

| 5-10 | 4 Years | |||

| 10-20 | 5 Years | |||

| >20 | 10 Years | |||

- Services: Jordan already enjoys near complete access to the U.S. services market. The FTA will open the Jordanian services market to U.S. companies. Specific liberalization has been achieved in many key sectors, including energy distribution, convention services, printing and publishing, courier services, audiovisual, education, environmental, financial, health services, tourism, and transport services.

- Intellectual property rights: These provisions incorporate the most up-to-date international standards for copyright protection. Among other things, Jordan has undertaken to ratify and implement the World Intellectual Property Organization’s (WIPO) Copyright Treaty and WIPO Performances and Phonograms Treaty within two years. These two treaties, sometimes referred to as the “Internet Treaties,” establish several critical elements for the protection of copyrighted works in a digital network environment, including creators’ exclusive right to make their creative works available online.

- Electronic commerce: For the first time in a free trade agreement, Jordan and the U.S. have each committed to promoting a liberalized trade environment for electronic commerce that should encourage investment in new technologies and stimulate the innovative uses of networks to deliver products and services. Both countries agreed to seek to avoid imposing customs duties on electronic transmissions, imposing unnecessary barriers to market access for digitized products, and impeding the ability to deliver services through electronic means.

- Labor provisions: For the first time in a U.S. trade agreement, rather than in a side agreement, the Jordan FTA includes in the body of the agreement key provisions that reconfirm that free trade and the protection of the rights of workers can go hand in hand. These provisions reaffirm the parties’ support for the core labor standards adopted in the 1998 International Labor Organization’s Declaration on Fundamental Principles and Rights at Work. The countries also reaffirmed their belief that is inappropriate to lower standards to encourage trade, and agreed in principle to strive to improve their labor standards. Each side agreed to enforce its own existing labor laws and to settle disagreements on enforcement of these laws through a dispute settlement process.

- Environmental provisions: Again, for the first time in the body of a free trade agreement, the Jordan FTA includes a separate set of substantive provisions on trade and the environment. Specifically, each country agreed to avoid relaxing environmental laws to encourage trade. The United States and Jordan affirmed their belief in the principle of sustainable development, and agreed to strive to maintain high levels of environmental protection and to improve their environmental laws. Each side also agreed to a provision on effective enforcement of its environmental laws, and to settle disagreements on enforcement of these laws through a dispute settlement process. Both countries are conducting environmental reviews, which were extremely useful in developing some of the provisions of the agreement.

The United States and Jordan also agreed on an environmental cooperation initiative, which establishes a U.S.-Jordanian Joint Forum on Environmental Technical Cooperation for ongoing discussion of environmental priorities, and identifies environmental quality and enforcement as areas of initial focus.

The environmental elements of the FTA package also include language on transparency and public input, and on environmental exceptions. Finally, the FTA includes a “win/win” initiative — an initiative that is good for both business and the environment by eliminating tariffs on a number of environmental goods and technologies and liberalizing Jordanian restrictions on certain environmental services.

- Consultation and dispute settlement: The United States envisions most questions on the interpretation of the agreement or compliance with the agreement being settled by either informal or formal government-to-government contacts. The FTA provides for dispute settlement panels to issue legal interpretations of the FTA, but only if the countries have first consulted and failed to resolve the dispute. The process includes strong provisions on transparency. The report of such dispute settlement panels is non-binding, and the affected country is authorized to take appropriate measures if the parties are still unable to resolve a dispute once a panel has issued its recommendations.

| U.S. and Jordanian tariff schedules | |

| United States Tariff Schedule | Hashemite Kingdom of Jordan Tariff Schedule |

| Link: https://www.usitc.gov/tata/hts/index.htm | Link: https://services.customs.gov.jo/JCcits/sections.aspx |

| Website of Jordan Customs: https://www.customs.gov.jo | |

- United States Tariff Schedule

- General Notes to the U.S Tariff Schedule

- Annex to the General Notes to the US Tariff Schedule

- Schedule of the United States of America

- Jordanian Schedule

- General Notes to the Jordanian Tariff Schedule

- Schedule of the Hashemite Kingdom of Jordan

- Memorandum of Understanding on Issues Related to the Protection of Intellectual Property Rights

- Memorandum of Understanding on Transparency in Dispute Settlement

- Joint Statement on WTO Issues

- Joint Statement on Technical Environmental Cooperation and Selected Technical Environmental Cooperation Programs

- Side letter on marketing approval of pharmaceutical products

- Side letter on GATS Article 5